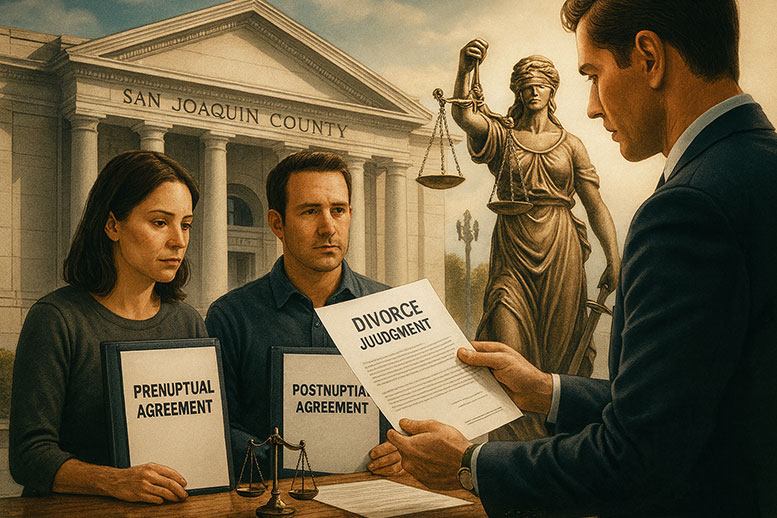

If you are facing divorce—or even just thinking ahead—you may find yourself wondering whether a prenuptial or postnuptial agreement will impact what you walk away with.

Perhaps you signed something years ago and now feel uncertain about what it truly means. Or maybe you never drafted any kind of agreement, and now feel exposed as your financial picture shifts.

These are not uncommon concerns. At Bansmer Law, we work with individuals throughout San Joaquin County who want to protect their rights, their assets, and their peace of mind—whether or not they have a marital agreement in place.

Below, we explore how prenuptial and postnuptial agreements impact asset division in California divorces, and what you need to know if you are planning ahead or preparing for separation.

How California Law Handles Property Division Without a Marital Agreement

California is a community property state. This means that, without a valid prenuptial or postnuptial agreement, the law generally presumes that all assets and debts acquired during your marriage belong equally to both spouses.

That includes income, retirement accounts, business profits, real estate, and even certain debts—regardless of who earned or acquired them.

However, property acquired before the marriage, as well as gifts or inheritances received by one spouse during the marriage, may be considered separate property. In divorce, only community property is subject to equal division, while separate property remains with the original owner.

Without a marital agreement, asset division defaults to this 50/50 rule. This is why many individuals choose to create a prenuptial or postnuptial agreement—to protect specific assets, clarify intentions, and reduce potential conflict in the event of divorce.

The Role of Prenuptial Agreements in San Joaquin Divorce Settlements

A prenuptial agreement (or “prenup”) is a written contract signed by both spouses before marriage. It allows you and your partner to define, in advance, how property will be divided if you divorce.

It can also clarify what will be considered community property versus separate property, how certain debts will be handled, and whether either spouse will receive spousal support.

Said another way, when a valid prenuptial agreement is in place, it can override California’s default community property laws. For example, your prenup might state that each spouse will keep their own income, retirement contributions, or business ownership—regardless of when those were earned.

That said, not all prenups are enforceable. San Joaquin County courts will examine whether the agreement meets all legal standards, including:

- Voluntary signing, without coercion

- Access to independent legal counsel

- Full and fair disclosure of assets by both parties

- Terms that are not “unconscionable” or grossly unfair at the time of enforcement

In other words, while a prenup can absolutely shape the outcome of a divorce case, it must be carefully drafted and executed. Poorly written or one-sided agreements are far more likely to be challenged or even invalidated in court.

The Role of Postnuptial Agreements in San Joaquin Divorce Settlements

A postnuptial agreement is similar to a prenuptial agreement, but it is created after you and your spouse are already married. These agreements are often used when financial circumstances change—such as a significant inheritance, business growth, or a desire to protect children from a previous relationship.

Your postnup may designate certain income or property as separate, outline how specific investments or accounts will be treated, or even establish how a family business will be handled in the event of divorce.

However, because postnups are put in place after the legal duties of marriage have gone into effect, courts examine them with care. Factors such as full disclosure, clarity of language, independent counsel, and fairness will all affect whether the postnup ultimately holds up in court.

Any indication that one party was pressured, misled, or inadequately informed could render the agreement unenforceable.

When drafted correctly, postnups are powerful tools that can bring peace of mind and stability—especially for couples navigating significant financial changes or rebuilding trust after conflict.

How Prenups and Postnups Protect Specific Types of Assets

Every marriage—and every financial picture—is different. That is why California law allows couples to define how certain assets will be handled in a divorce, rather than relying solely on the community property default.

Prenuptial and postnuptial agreements are especially valuable for high-value or complex assets, such as family businesses, retirement plans, or inheritances. When drafted correctly, these agreements can shield assets from unintended division and help preserve financial stability for both parties.

Below are three key asset categories where marital agreements can make a significant impact.

Can a Prenup Protect Inheritance from Being Divided?

Yes, but only if it is drafted and executed properly. California generally considers inheritances to be separate property. However, that protection can erode quickly if your inheritance is deposited into a joint account, used for shared expenses, or invested in marital property like the family home.

A prenuptial agreement can preempt confusion by clearly stating that any inheritance received by either spouse will remain their separate property, even if received during the marriage. This kind of clarity is especially important if you expect to inherit real estate, agricultural land, or significant financial assets.

Without a prenup, the spouse who received the inheritance must prove it remained separate—and that can easily become a contested issue if records were not maintained or the funds were used jointly.

How Do Postnups Handle Business Ownership?

Postnuptial agreements are often used to protect business interests—especially when the business was started or substantially expanded during the marriage.

A postnup can outline who retains control of the business, how its value will be determined in a divorce, and whether one spouse will have any ownership claim. This can be particularly important for family-run businesses, agricultural operations, or closely held corporations based in Stockton, Tracy, or San Joaquin.

Because spouses owe each other fiduciary duties during marriage, postnups involving business ownership must be detailed, transparent, and mutually fair. Courts will look closely at whether both parties understood the business’s value, potential growth, and associated debts before signing.

Can a Prenup Protect Retirement Accounts in California?

Yes—retirement accounts can be addressed directly in a prenuptial agreement. In California, retirement savings earned during the marriage are usually considered community property, meaning they are subject to division.

However, a prenup can alter that default by specifying how retirement accounts will be treated.

For example, it might state that each party will keep their own retirement savings, even if accrued during the marriage. Alternatively, the agreement might outline a specific split or tradeoff involving other assets.

Because retirement accounts are often one of the most valuable assets in a divorce, any agreement involving them must be clearly written, properly disclosed, and consistent with California law. Otherwise, the court may disregard those provisions entirely.

What Makes These Agreements Legally Enforceable

Whether you are relying on a prenup or considering drafting a postnup, enforceability is everything. In California, both types of agreements must meet the following standards:

- Voluntary and free of coercion

- Written and signed by both parties

- Full financial disclosure by both spouses

- Fair and reasonable terms that do not leave one party destitute

- Independent legal representation for each party (strongly recommended)

The court may refuse to enforce any agreement that appears one-sided, vague, or executed under suspicious circumstances. This is especially true for postnups, where courts will scrutinize the intent and fairness of both parties.

If you already have a marital agreement in place, it may be wise to have it reviewed by a San Joaquin County divorce attorney to ensure it still meets legal standards and accurately reflects your financial picture.

Why Legal Guidance Is Essential—Whether You Have a Marital Agreement or Not

Prenuptial and postnuptial agreements are complex, high-stakes documents that intersect with deeply personal issues—business ownership, family dynamics, generational wealth, and trust, just to name a few.

If you have an agreement in place, it is critical to understand whether it will hold up in court and what rights it preserves (or limits). If you do not have one yet, but are feeling uncertain about your financial future, now is the time to seek clarity.

At Bansmer Law, we help clients throughout San Joaquin County navigate these exact questions with strategy, discretion, and care. With the right legal guidance, they can be tools of protection, fairness, and peace of mind—before, during, or even after marriage.

If you are unsure what your marital agreement means—or wondering if you should draft one—Bansmer Law is here to help. Call (209) 474‑2400 today to schedule your consultation and get the peace of mind you deserve.

CALL US NOW

CALL US NOW