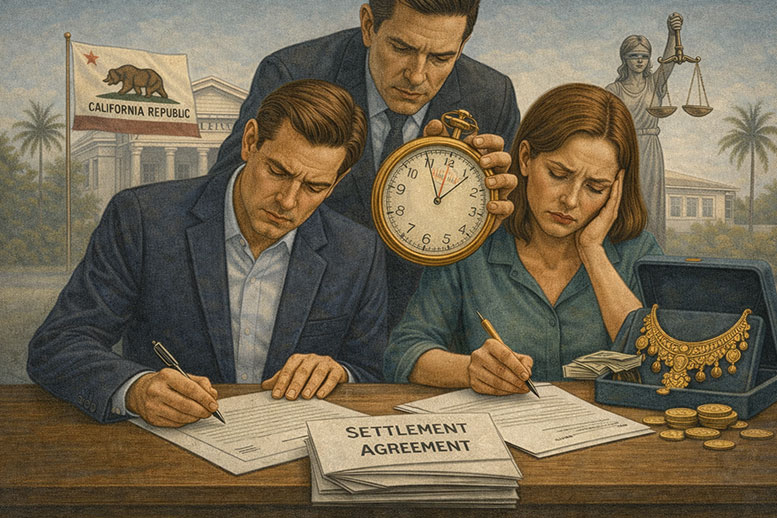

“I cannot do this anymore. Just tell me where to sign.” After eighteen months of contentious court hearings, David was ready to be done. His spouse’s attorney kept pushing for a quick settlement, while his friends told him to move on with his life. So, he signed and finalized a settlement that seemed fair enough at the time.

But six months later, David discovered stock options worth $340,000 that somehow never made it onto the financial disclosure forms, a family business valued at $900,000 that an independent appraiser later said was worth $1.6 million, and rental property income that had been underreported by nearly $4,000 per month for three years.

The total cost of “just being done” and signing totaled approximately $1.2 million in lost or unrecovered assets.

David’s story is hypothetical, but situations like this play out every day. In high-net-worth San Joaquin County divorces, exhaustion is currency. Your impatience has a price tag, and your spouse’s attorney knows exactly what it is worth.

This is just one of many reasons why you shouldn’t rush a settlement in a multi-million dollar San Joaquin County divorce. Read on to learn exactly what you risk by trying to expedite this process.

1. You Are Accepting Their Version of What You Own

In a high-asset divorce, the financial picture is rarely straightforward. You are not just dividing a checking account and a house. You are navigating executive compensation packages, deferred stock options, business interests, rental properties, cryptocurrency holdings, and retirement accounts with complex vesting schedules.

When you rush, you accept the financial disclosures your spouse provides without independent verification.

You skip hiring a forensic accountant because “this process is already expensive enough.” You agree to their business valuation without getting your own expert. You do not subpoena records from accounts you suspect exist but cannot prove.

And that decision has consequences, like the “forgotten” cryptocurrency wallet worth $180,000. Or the art collection that a friend of your spouse appraised at half its actual market value.

In San Joaquin County, CA, the law does require mandatory financial disclosures during divorce proceedings. But enforcement depends entirely on your follow-through. This can mean hiring forensic accountants to identify patterns of income manipulation, or working with certified experts to provide an accurate business valuation.

Ultimately, the best way to uncover hidden wealth in California divorces is by being patient and giving the discovery process enough time to work. Rushing through this phase means betting millions that your spouse is being completely transparent.

Are you willing to take that bet?

2. You Are Trading Equal Assets for Unequal Tax Consequences

“Fine, you keep the stocks. I will take the retirement account. Each is worth the same amount.” This is one of the most expensive decisions you can make during a divorce settlement.

Why? Because $1 million in taxable stock does not equal $1 million in a traditional IRA. After taxes, you are walking away with approximately $600,000 while your spouse keeps $800,000.

Meanwhile, the house you “won” in the settlement might come with a $200,000 capital gains tax bill when you eventually sell.

You see, every asset class has different tax treatment. Stock options face ordinary income tax at exercise, but real estate carries capital gains implications based on cost basis and holding period. Retirement accounts trigger penalties if accessed before age 59½. These are just a few examples.

And while it is true that California community property law requires equal division of marital assets, “equal” means equal after-tax value, not equal face value.

This is an issue because judges at the San Joaquin County Superior Court Family Law Division expect proper tax analysis in high-asset cases. By the time the problem surfaces, you have already signed away your leverage.

Understanding complex financial situations in divorce requires collaboration with tax professionals, financial planners, and attorneys who specialize in high-net-worth cases. That collaboration takes time. Rush the analysis, and you are volunteering for a six-figure tax bill your spouse likely saw coming from day one.

3. You Are Making Permanent Mistakes on Custody and Support Terms

Vague language in a divorce agreement is not a problem that you can fix later. This tactic is a classic financial trap with consequences that compound over the years.

“We will figure out the details of the parenting schedule later.” “Spousal support will be determined based on reasonable need.” “Child support calculations will account for standard income sources.”

These provisions sound cooperative and can even feel like progress. But in reality, they are disasters waiting to happen:

- When custody terms are too vague to enforce, you have no recourse when your ex violates them

- When spousal support lacks clear modification conditions, you cannot adjust payments even when your financial circumstances change drastically

- When life insurance is not required as part of child support, those payments disappear the moment your ex dies

- When child support is calculated without accounting for deferred compensation, bonuses, stock options, or other variable income, you are leaving thousands of dollars per month on the table

In high-income divorce cases, these “small details” add up fast. A $3,000 monthly gap in child support becomes $216,000 over six years of payments, for example.

Ultimately, family law judges enforce what is written in your agreement. Once your divorce is finalized, modifying incomplete or ambiguous terms requires proving substantial changed circumstances—a high legal bar that costs tens of thousands of dollars to attempt and often fails.

What feels like a minor compromise today becomes a $200,000 problem that you cannot undo.

Your Exhaustion Is Temporary, But The Financial Consequences of Rushing Are Permanent

Yes, you are tired. Yes, this process feels excruciating. Yes, you want it to just be over.

But in a multi-million dollar San Joaquin County divorce, the difference between settling in three weeks versus three months can be $500,000, $1 million, or more. Rushing does not make the pain go away. It just transfers wealth from your pocket to your spouse’s.

Think about what you are actually trading. A few extra months of legal proceedings, in exchange for financial security that will last decades. Temporary discomfort now, in exchange for protecting assets you spent years building.

The relief you feel from signing quickly will be replaced by regret when you see what you gave up. The frustration of waiting will fade, but the financial consequences of rushing will not.

Working with an experienced attorney who understands the stakes in high-net-worth divorce means protecting what you built, advocating for terms that reflect reality rather than desperation, and using every available legal tool to ensure your settlement is both fair and enforceable.

At Bansmer Law, we have guided clients through complex, high-conflict divorces in San Joaquin County for over a decade. We know how exhausting this process is. We also know what it costs when people give up too soon.

Do not let exhaustion cost you your financial future. Call (209) 474-2400 today to schedule your consultation.

Frequently Asked Questions About Multi-Million Dollar San Joaquin County Divorces

Is a high-net-worth divorce public record in San Joaquin County?

Yes, divorce filings in San Joaquin County are generally public record. However, you can request that certain financial details be filed under seal to protect sensitive business information, asset valuations, or other confidential data.

Courts may grant these requests when privacy concerns outweigh public interest. Discuss protective orders and sealed filings with your attorney early in the process for the best results.

Does California have a spousal support formula for high earners?

No, California does not use a strict formula for long-term spousal support in high-income cases. Judges consider multiple factors under Family Code Section 4320, including marriage length, each spouse’s earning capacity, age, health, and marital standard of living.

Temporary support may use guideline calculations, but permanent awards require individualized analysis and often involve expert testimony about future earning potential.

Who are the top high-asset divorce attorneys in San Joaquin County?

Choosing the right attorney depends on your specific case complexity, asset types, and goals. Look for attorneys with extensive experience in forensic discovery, business valuation disputes, and high-conflict negotiations.

Attorney Erica M. Bansmer of Bansmer Law has over a decade of experience representing clients in complex, high-asset divorces throughout San Joaquin County. Schedule a consultation today to discuss your case.

CALL US NOW

CALL US NOW